Win

This is how bitcoin will Win#

Gun is Law#

Code is free speech, enforcement can only be done via threat of violence.

Gov/private city can tax 1 to 5 % to hire for security, and the governmental structure would be very limited to what they can fund.

https://x.com/securitybrahh/status/1928036042491429287

Commercial Contracts?#

ots-notorized-otspgp-signed-doc on op_Return?

${\textsf{\color{red}MAYBE}}$ least dust on chain contracts - https://x.com/robin_linus/status/1824004440099053949

UX dashboard for private city police to check docs, laws, etc

https://x.com/securitybrahh/status/1927044965084869061

https://github.com/ArmanTheParman/bitvotr

Central bank#

Bitcoin HAS replaced central banks they just don’t know that yet.

Banks#

For bitcoin banks to exist you need:

- no central bank (btc is global “central” bank)

- no legal tender (ppl decide, not gov)

- crypto-friendly legislation (Gun is law)

Only El Salvador and Panama seems to be places for bitcoin banks rn.

Sad.

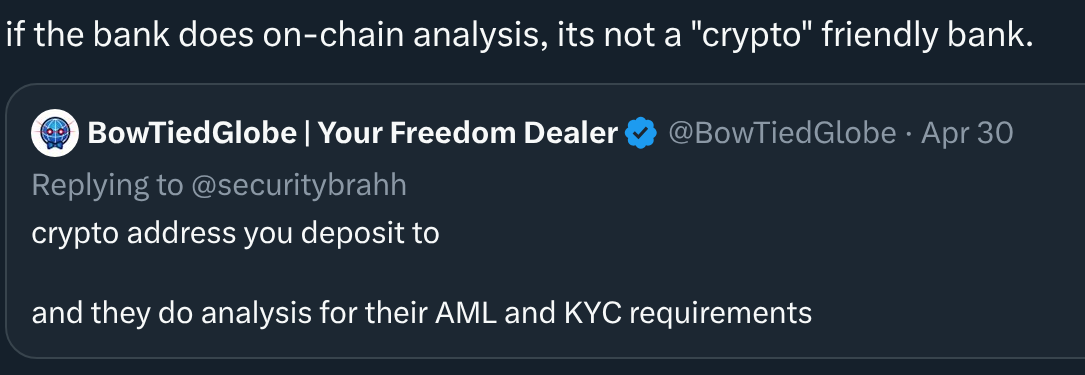

do they do on-chain analysis?

— sovereign Shadow (@securitybrahh) April 30, 2025

if yes they are not "crypto" friendly.

Alao does the bank account has a crypto address I deposit to, or I place orders on an exchange?

Custodians#

https://bitkey.build/inheritance-is-live-heres-how-it-works/

https://blog.casa.io/introducing-casa-vault/

https://armantheparman.com/inheritance/

Company Ledgers#

We need a sidechain that protects privacy of unit of accounts of companies, liquid is a federation not a sidechain.

Post Liquid - A better porotocol on top of or side of the bitcoin chain, as bitcoin as the underlying asset in the Censensus.

Who can peg out? Public can not independently peg-out, which means they require from a Federation member to convert L-BTC back to BTC

Also companies need to have privacy if btc is accepted as unit of account, albeit some info can be in black and white (btc) {countries have portals for disclosures, filings etc}

Inter-country Settlements#

"""

Investment firm VanEck has confirmed that China and Russia are now settling energy transactions using BTC, ditching the US dollar system amid rising global friction.

Nations like Bolivia are also exploring crypto for power imports, while French utility EDF eyes Bitcoin mining.

Investors and analysts are highlighting Bitcoin’s growing appeal as a non-debasable asset and a hedge against currency devaluation, noting it cannot be manipulated by governments in uncertain economic times.

"""

https://www.btcbreakdown.com/p/issue-219

SWIFT#

The federation of Liquid,

Cash#

bitcoin in its current state is not fungible but it can be solved via https://joinstr.xyz/

Bitcoin stick -disposable wallet- https://opendime.com/faq

Lightning is better at privacy (i.e. its cash) than monero-the-shitcoin

1st, 2nd & 4th Amendment#

https://x.com/securitybrahh/status/1928792148922741131

Trojan Horse#

https://bitcoinlaws.io/federal

https://bitcointreasuries.net/

Addendum A#

https://free-cities.org/free-private-cities-whitepaper/

Feedback#

If you have any questions from this post or would like more information on a specific aspect, please reach out via Email, X, or Nostr.